Prediction Markets Bet Bitcoin (BTC) Unlikely to Break $100,000 Before Year-End

Bitcoin's bullish sentiment has significantly weakened since the price crash on October 10, with the likelihood of BTC breaking the $100,000 price level in the short term gradually fading.

BTC weakened after the Federal Reserve announced its interest rate cut decision on Wednesday, and it is expected to be difficult to break through the $100,000 mark in the remaining time of 2025.

Key Points:

According to prediction markets, the probability of BTC's price reaching $100,000 before January 1 is only 30%.

BTC reserve buying activity has significantly slowed, hindering short-term market recovery.

BTC is currently facing resistance around $94,000 and may break through to the $98,000 liquidity area via an ascending triangle pattern.

Only 30% Chance for BTC to Reach $100,000 Before Year-End

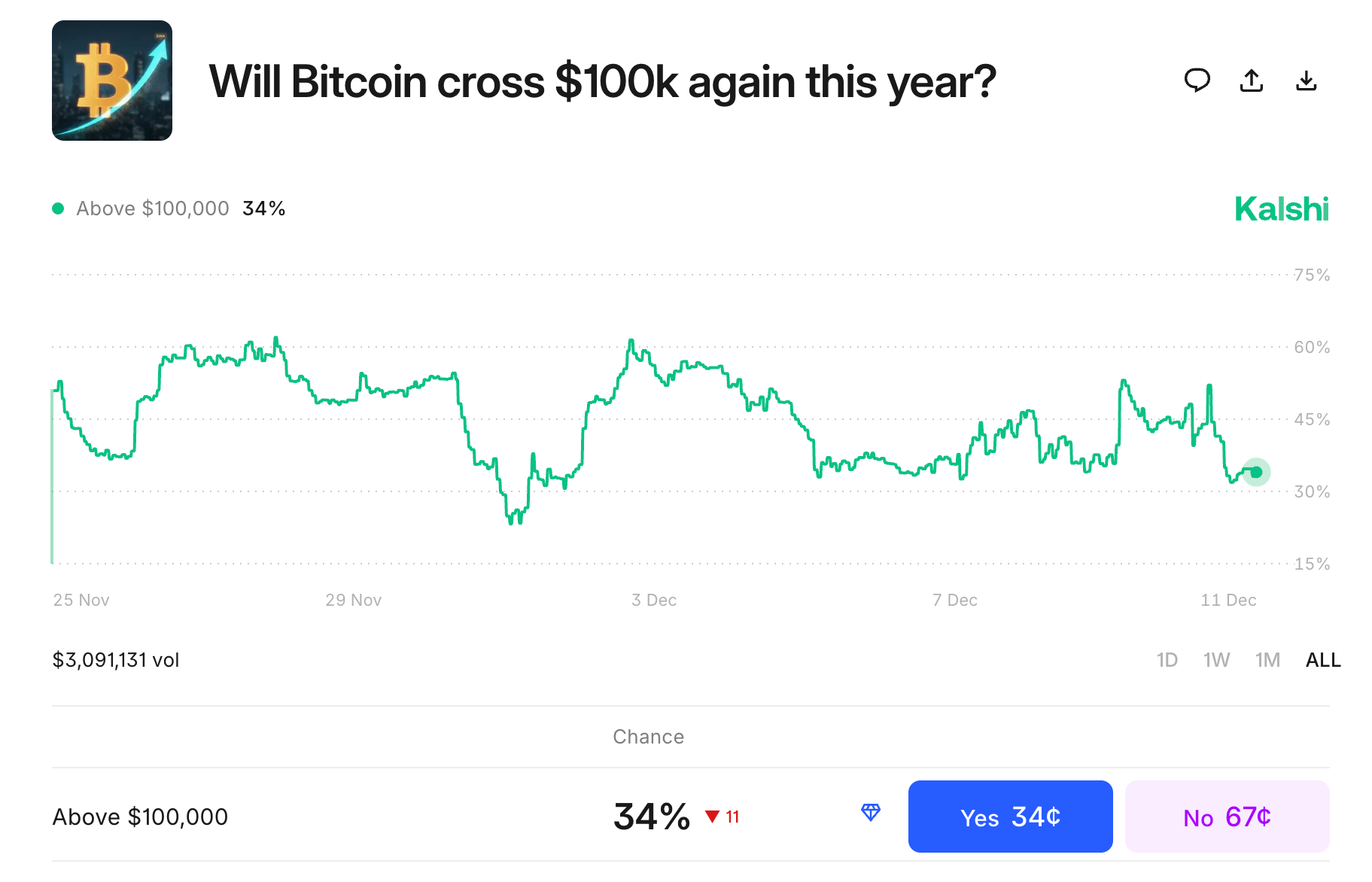

Most traders on the Polymarket and Kalshi trading platforms expect BTC to remain below the $100,000 mark in the next 21 days.

As of December 11, investors on the Kalshi platform predicted a probability of about 34% for BTC to break through $100,000 before December 31. Meanwhile, Polymarket set the probability of BTC touching $100,000 before the end of 2025 at 29%.

BTC's highest point in December occurred on Tuesday, reaching $94,600, while the BTC/USD trading pair last stood above $100,000 on November 13.

Multiple factors have suppressed BTC's short-term rebound attempts, including growing macroeconomic uncertainty and the slowdown in BTC reserve purchases.

Data from Capriole Investments shows that the daily average purchase rate of BTC by enterprises continues to decline, indicating that investors may have entered a state of fatigue.

Despite the weakening demand for BTC reserves, Polymarket predicts that the possibility of Strategy selling BTC before the end of the year remains low, while expectations for regular small purchases continue to remain high.

Polymarket traders still believe that Strategy's routine purchase this week is a high-probability event, with a 65% chance of buying over 1,000 BTC.

Last week, Strategy raised approximately $962.7 million to purchase 10,624 BTC, expanding its BTC reserves to 660,624,有望 matching last year's BTC purchase scale.

BTC's Upside May Be Limited to $98,000

Data from Cointelegraph Markets Pro and TradingView shows that the BTC/USD trading pair has been consolidating within an ascending triangle in a shorter time frame.

Analyst Daan Crypto Trades pointed out in a Wednesday X post that the price is "once again challenging this resistance level," referring to the supply area between the $93,300 annual opening price and $94,000.

A breakout and consolidation above $94,000 should push the price towards the triangle's measured target of around $108,000, but Daan Crypto Trades stated that it might only rise to "the support area around ~$98,000 before retesting," adding:

"This is also where a lot of liquidity is concentrated."

As reported by Cointelegraph, buyers need to push BTC above $94,589 to open the door to retesting the $98,000-$100,000 area.

Related recommendation: Bitcoin (BTC) volatility intensifies before the "hawkish" FOMC meeting, fails to break the $93,500 annual opening price level

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. Although we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements subject to risks and uncertainties. Cointelegraph is not responsible for any losses or damages resulting from reliance on this information.